Hyperswap Exchange: Pioneering the Next Era of Decentralized Trading

In an era where decentralized finance (DeFi) has redefined the contours of global finance, Hyperswap Exchange emerges as a groundbreaking platform that seamlessly bridges security, liquidity, and innovation. As cryptocurrency adoption surges and traditional exchanges grapple with issues ranging from regulatory bottlenecks to centralized risks, Hyperswap positions itself as a compelling alternative that epitomizes the true ethos of blockchain: trustless, transparent, and permissionless finance.

What is Hyperswap Exchange?

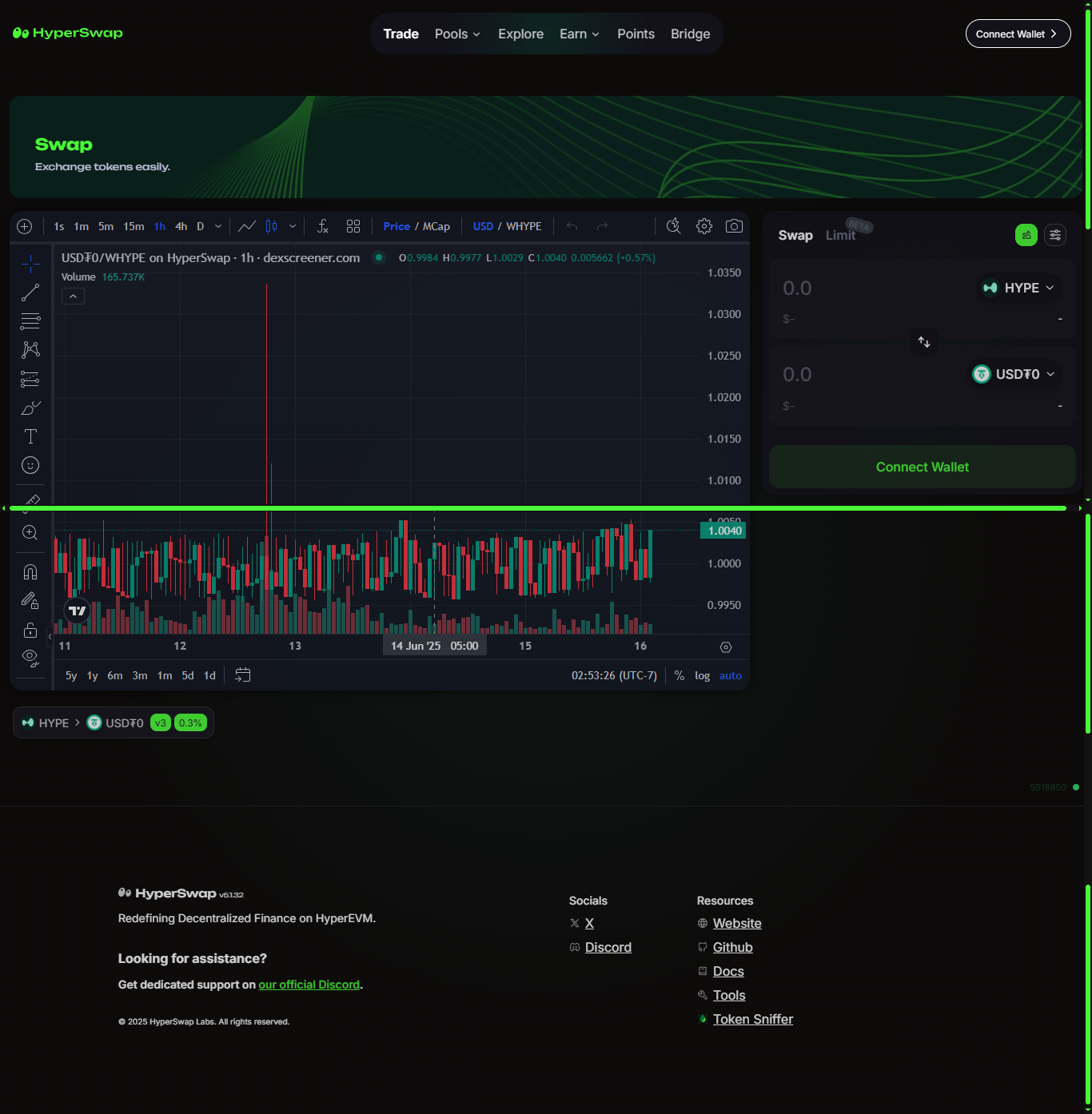

Hyperswap Exchange is a decentralized exchange (DEX) protocol designed to facilitate peer-to-peer trading of digital assets without the need for intermediaries. Built on robust smart contracts, it allows users to swap tokens directly from their wallets, ensuring complete ownership and autonomy over their funds. Unlike centralized exchanges that require custody of assets, Hyperswap leverages automated market maker (AMM) algorithms, which utilize liquidity pools to execute trades seamlessly and efficiently.

The Underlying Algorithm: A Sophisticated AMM Model

At the heart of Hyperswap lies an advanced variant of the constant product market maker (CPMM) algorithm, a refinement over the popular model pioneered by Uniswap. By intelligently adjusting the liquidity curve, Hyperswap minimizes slippage even during high-volume transactions. This means traders can execute large orders with reduced price impact, enhancing overall capital efficiency.

Moreover, Hyperswap’s algorithm incorporates dynamic fee adjustments. During periods of heightened volatility, fees are marginally increased to incentivize liquidity providers (LPs) to maintain balanced pools, thereby stabilizing the market. Conversely, during stable periods, fees taper down, ensuring traders benefit from competitive rates.

Why Hyperswap is a Game-Changer

1. Decentralization with Enhanced Security

Hyperswap eliminates single points of failure by distributing control through immutable smart contracts. Users retain custody of their private keys, mitigating risks of hacks or mismanagement often associated with centralized exchanges. This architecture not only fortifies security but also aligns with the decentralized philosophy that underpins blockchain technology.

2. Deep Liquidity and Yield Incentives

Liquidity is the lifeblood of any exchange. Hyperswap incentivizes LPs by offering attractive yields generated from trading fees and occasional governance token rewards. This creates a positive feedback loop: deeper liquidity leads to tighter spreads and lower slippage, which in turn attracts more traders, perpetuating ecosystem growth.

3. User-Friendly Interface and Cross-Chain Capability

Despite its sophisticated backend, Hyperswap offers an intuitive user interface. Even novice users can connect their wallets and execute trades within seconds. Additionally, ongoing integrations with cross-chain bridges will soon enable seamless swaps across multiple blockchains, thereby broadening asset diversity and unlocking unprecedented interoperability.

A Responsible Approach to Decentralized Trading

While Hyperswap presents myriad advantages, it remains steadfast in emphasizing transparency. Each transaction is verifiable on-chain, fostering trust. Furthermore, the protocol undergoes periodic audits by reputed cybersecurity firms, underscoring its commitment to safeguarding user assets.

The governance framework also warrants mention. Through decentralized autonomous organization (DAO) voting, stakeholders can propose and enact changes to fee structures, new liquidity pools, or even strategic partnerships. This participatory model ensures that Hyperswap evolves in harmony with the community’s collective vision.

The Road Ahead: Innovations on the Horizon

Looking forward, Hyperswap’s roadmap is replete with ambitious initiatives. Plans include integrating advanced oracle solutions for real-time pricing, launching impermanent loss protection mechanisms to shield LPs, and deploying machine learning algorithms to predict optimal liquidity rebalancing strategies.

Such enhancements are not mere incremental upgrades; they represent a paradigm shift, positioning Hyperswap at the vanguard of decentralized financial infrastructure.

Conclusion

In summation, Hyperswap Exchange exemplifies the confluence of innovation, security, and community-driven governance. By harnessing cutting-edge algorithms and staying true to the decentralized spirit of blockchain, it charts a promising course for the future of digital asset trading. For anyone seeking a resilient, transparent, and efficient platform to navigate the crypto markets, Hyperswap is undeniably a name to watch—and perhaps, to trust with the next generation of financial interactions.

Made in Typedream